Accelerate Your Business: How Supplier Invoice Financing Can Boost Your Financial Agility | Fynance

Published bya. Introduction

Supplier invoice financing is a financing solution where a financial institution pays a company's suppliers on their behalf in exchange for a fee. This allows suppliers to receive payment for their invoices immediately, while the company can extend their payment terms without negatively impacting their supplier relationships. The company then repays the financial institution at a later date with interest, typically within 30-90 days. Supplier invoice financing can help companies improve their cash flow management, increase purchasing power, and maintain good supplier relationships. It can also provide suppliers with access to affordable financing without the need for collateral or extensive credit checks. However, businesses should consider the eligibility requirements, fees, and potential risks before using supplier invoice financing. Alternatives to supplier invoice financing include traditional bank loans, trade credit, asset-based financing, and supply chain financing. Overall, supplier invoice financing is a flexible and convenient financing option for businesses looking to manage their cash flow while maintaining positive supplier relationships.

Photo By: IIFL Finance

b. Importance of Managing Cash Flow for Businesses

Managing cash flow is essential for the survival and success of any business. Cash flow refers to the movement of money in and out of a business, including revenue, expenses, and investments. Businesses need to manage their cash flow effectively to ensure they have enough cash on hand to cover expenses, pay suppliers, and invest in growth opportunities. Poor cash flow management can lead to cash shortages, missed payments, and even bankruptcy.

Effective cash flow management involves forecasting cash flow, monitoring expenses, maintaining adequate cash reserves, and prioritizing payments. By managing their cash flow effectively, businesses can make informed decisions, take advantage of growth opportunities, and reduce the risk of financial difficulties. In addition, businesses with positive cash flow may be better able to negotiate favourable terms with suppliers, secure loans, and build strong credit scores. Overall, managing cash flow is critical for businesses of all sizes and industries to ensure their financial stability and long-term success.

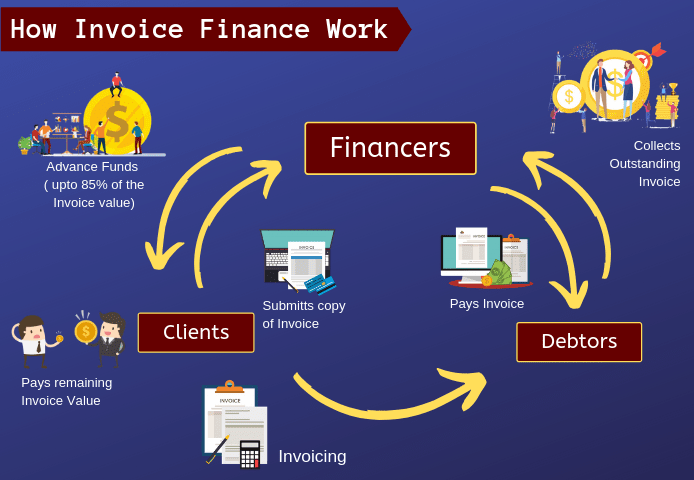

Photo By: Merchant Maverick

c. How Supplier Invoice Financing Works

The role of financial institutions in supplier invoice financing is to provide the necessary capital to pay a company's suppliers on their behalf. When a company enters into a supplier invoice financing agreement, the financial institution pays the supplier the outstanding invoice amount, typically within a few days. In exchange for this service, the financial institution charges the company a fee or interest rate, which is typically lower than other forms of financing. The company then repays the financial institution at a later date. Financial institutions also perform due diligence on the company and its suppliers to assess creditworthiness and eligibility for financing. This includes reviewing financial statements, credit reports, and other relevant information to ensure that the company is financially stable and able to repay the financing.

Payment terms in supplier invoice financing vary depending on the agreement between the company, its suppliers, and the financial institution. Typically, payment terms range from 30-90 days. Under supplier invoice financing, the financial institution pays the supplier the outstanding invoice amount on behalf of the company. The company then repays the financial institution at a later date with interest, usually within the agreed-upon payment terms. Repayment options also vary and can include a lump sum payment or instalment payments over the repayment period. Some financial institutions may also offer flexible repayment options based on the company's cash flow or revenue streams.

It's essential for companies to carefully consider the payment terms and repayment options before entering into a supplier invoice financing agreement. Companies should ensure they have a clear understanding of the terms, interest rates, fees, and any potential penalties for late payments or default. By doing so, companies can effectively manage their cash flow and maintain positive supplier relationships while using supplier invoice financing to their advantage.

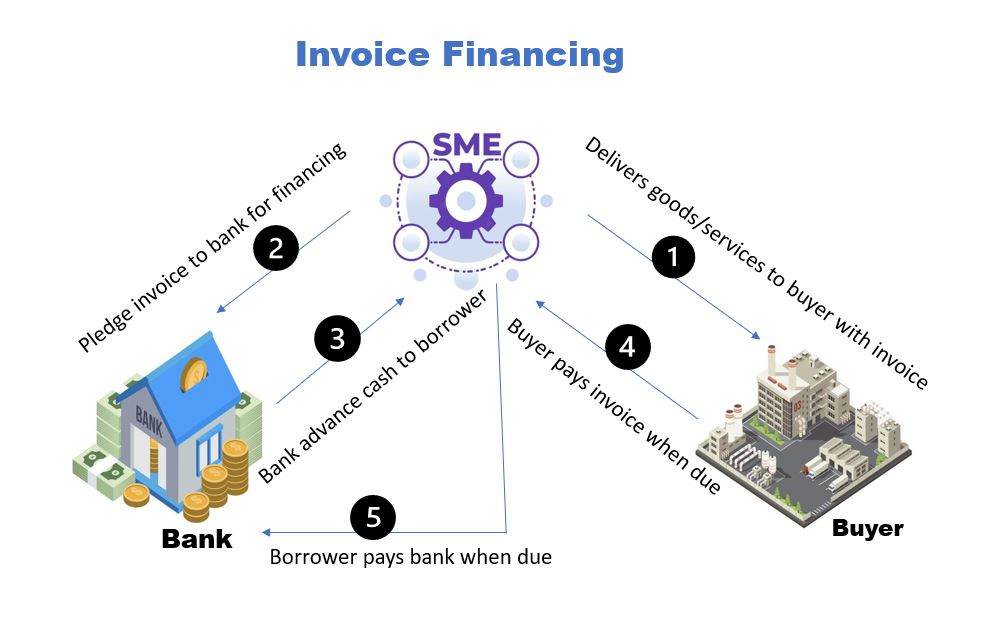

There are several types of supplier invoice financing available, including:

Factoring: This involves the sale of outstanding invoices to a financial institution at a discounted rate.

Reverse factoring: Here, the financial institution pays the supplier on behalf of the company, with the company repaying the financial institution at a later date.

Dynamic discounting: This allows suppliers to offer early payment discounts to the company, incentivizing the company to pay earlier.

Supply chain finance: This type of financing allows suppliers to receive financing based on the creditworthiness of the company, rather than the supplier's creditworthiness.

Spot factoring: This allows companies to selectively finance individual invoices, rather than their entire accounts receivable.

Each type of supplier invoice financing has its advantages and disadvantages, and companies should carefully consider their options before selecting the most appropriate financing solution for their needs.

Photo By: Connect2India

d. Advantages of Supplier Invoice Financing

1. Improved cash flow management

Improved cash flow management can provide businesses with several benefits, including the ability to pay suppliers on time, reduce the risk of cash shortages, and take advantage of growth opportunities. By effectively managing cash flow, businesses can also improve their credit scores, negotiate favourable terms with suppliers, and reduce the risk of financial difficulties. Improved cash flow management requires regular monitoring of expenses and cash reserves, prioritization of payments, and accurate forecasting of cash flow.

2. Increased purchasing power

By using supplier invoice financing, businesses will extend their payment terms with suppliers while still providing prompt payment. This improves cash flow and provides the business with increased purchasing power. The business can use this increased purchasing power to negotiate better terms with suppliers, bulk purchase discounts, and invest in new growth opportunities. Ultimately, supplier invoice financing can provide businesses with the flexibility and capital they need to manage their cash flow and make strategic purchasing decisions.

3. Enhanced supplier relationships

Supplier invoice financing can enhance supplier relationships by allowing companies to pay suppliers promptly and reliably. This improves the supplier's cash flow, reducing the risk of supply chain disruptions and improving overall supplier satisfaction. Supplier invoice financing also reduces the need for companies to negotiate payment terms with suppliers, as the financial institution handles the payment. As a result, businesses can focus on building stronger, long-term relationships with their suppliers and working together to achieve common goals, such as reducing costs and increasing efficiency.

4. Access to affordable financing

Supplier invoice financing provides businesses with access to affordable financing by offering lower interest rates and fees compared to other financing options, such as traditional bank loans or lines of credit. This is because the financing is secured by the outstanding invoices of the company, reducing the risk for the financial institution. Additionally, supplier invoice financing does not require collateral or personal guarantees, making it more accessible to businesses with limited assets or credit history. This can help businesses manage their cash flow effectively and access the financing they need to grow and expand.

5. Flexibility and convenience

Supplier invoice financing offers flexibility and convenience to businesses as it allows them to access financing quickly and easily, without the need for lengthy applications or collateral. The financing can be tailored to the specific needs of the business, with flexible repayment options and customized payment terms. This makes it a convenient option for businesses with fluctuating cash flow or seasonal demand. Additionally, supplier invoice financing can be used selectively, allowing businesses to finance individual invoices as needed, rather than their entire accounts receivable. Overall, supplier invoice financing offers businesses the flexibility and convenience they need to manage their cash flow and grow their business.

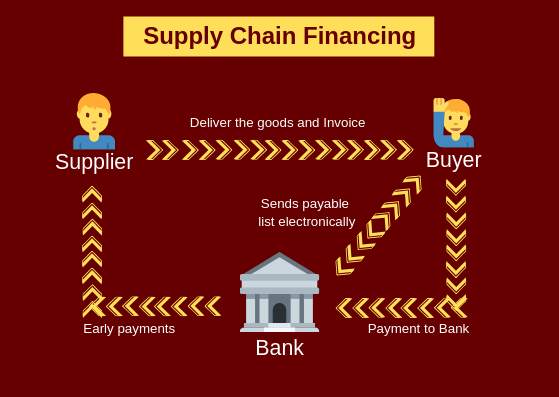

Photo By: OCBC Bank

e. Considerations for using supplier invoice financing

1. Eligibility requirements

The eligibility requirements for supplier invoice financing will be varied depending on the financial institution and type of financing. Generally, businesses must have a minimum credit score and an established credit history to be eligible. They must also have a minimum annual revenue and a certain number of outstanding invoices to finance. In addition, the financial institution will review the creditworthiness of the business's suppliers, as they will be paying the suppliers directly on behalf of the business. Other requirements may include a minimum time in business, a specified industry, and the absence of any legal or financial issues. Businesses should carefully review the eligibility requirements before applying for supplier invoice financing.

2. Fees and interest rates

Fees and interest rates for supplier invoice financing could be depending on the financial institution and type of financing. Generally, fees are charged for services such as credit checks, invoice processing, and account management. These fees can be a percentage of the invoice amount or a flat fee. Interest rates are charged on the financing amount and can be either fixed or variable. The interest rate charged will depend on factors such as the creditworthiness of the business and its suppliers, the repayment terms, and the amount of financing required. It is important for businesses to carefully review the fees and interest rates associated with supplier invoice financing before agreeing to the financing terms.

3. Potential impact on credit score

Supplier invoice financing has a positive impact on a business's credit score if the business makes timely payments on its outstanding invoices. By paying suppliers on time, the business can establish a positive payment history, which is a key factor in determining creditworthiness. Additionally, by using supplier invoice financing, businesses can reduce the risk of cash shortages and missed payments, which can negatively impact their credit score. However, if the business is unable to make timely payments on its financing, it can hurt its credit score. Businesses should carefully manage their cash flow and finances to ensure they can make payments on time and maintain a positive credit history.

4. Potential risks and downsides

While supplier invoice financing provides businesses with several benefits, there are also potential risks and downsides to consider. One of the main risks is that if the business is unable to make payments on its financing, it could damage its credit score and relationship with suppliers. Additionally, businesses may incur additional fees and interest rates associated with the financing. There is also the risk of the financial institution not approving the financing, which can impact the business's cash flow. Businesses should carefully evaluate the potential risks and downsides before using supplier invoice financing and ensure they have a solid plan in place to manage their cash flow and finances effectively.

Photo By: SME Loan

f. Alternatives to Supplier Invoice Financing

1. Traditional bank loans

Traditional bank loans are a common financing option for businesses, which provide a lump sum of money that is repaid over a specified period with interest. These loans may require collateral, such as property or inventory, and may involve a lengthy application process, credit checks, and financial reviews. Interest rates on traditional bank loans can be fixed or variable and may be higher than other financing options. Bank loans may be suitable for businesses with established credit history and collateral, but may not be accessible for smaller or newer businesses.

2. Trade credit

Trade credit is a type of financing that allows businesses to purchase goods or services from suppliers on credit, with payment due at a later date. The supplier extends credit to the buyer based on their creditworthiness, allowing the buyer to obtain the goods or services they need without paying upfront. Trade credit terms can vary, with payment due within 30, 60, or 90 days. Trade credit is a common financing option for businesses with established relationships with suppliers and can help them manage their cash flow and inventory. However, late payments can negatively impact the buyer's creditworthiness and relationship with the supplier.

3. Asset-based financing

Asset-based financing is a method of financing that uses a business's assets as collateral for a loan. These assets can include inventory, equipment, and accounts receivable. The loan amount is typically based on the value of the assets, and the lender may conduct regular audits to ensure the assets are still available and have not decreased in value. Asset-based financing can provide businesses with access to capital without requiring a long credit history or a high credit score, making it a suitable option for newer or smaller businesses. However, interest rates can be high, and failure to repay the loan can result in the loss of the collateral.

4. Supply chain financing

Supply chain financing helps businesses optimize their cash flow by improving the payment terms with their suppliers. The financing provider pays the supplier on behalf of the buyer, allowing the buyer to extend their payment terms without negatively impacting the supplier. The buyer then repays the financing provider with interest, typically within 90 to 120 days. Supply chain financing can provide businesses with access to affordable financing and help them improve their supplier relationships. However, it may not be accessible for all suppliers, and there may be fees associated with the financing.

Photo By: Connect2India

g. Conclusion & Recommendations for Businesses Considering Supplier Invoice Financing

Supplier invoice financing can provide businesses with several benefits, including improved cash flow management, enhanced supplier relationships, and increased purchasing power. However, businesses should carefully consider the potential risks and downsides of this financing option, such as the potential impact on credit score, fees and interest rates, and eligibility requirements. Here are some recommendations for businesses considering supplier invoice financing:

Evaluate your cash flow needs: Consider whether supplier invoice financing is the right option for your business's cash flow needs. Identify your payment terms and invoicing schedule to determine how much financing you may require.

Research financing providers: Research various financing providers to compare fees, interest rates, and repayment options. Choose a provider that aligns with your business needs and values.

Review eligibility requirements: Review the eligibility requirements for the financing to ensure that your business meets the necessary criteria. If your business is not eligible, consider alternative financing options.

Create a repayment plan: Create a repayment plan to ensure that your business can make payments on time and maintain a positive payment history.

Monitor your credit score: Monitor your credit score regularly to ensure that your financing is not negatively impacting your creditworthiness.

By carefully considering these recommendations, businesses can make an informed decision about whether supplier invoice financing is the right financing option for their needs and manage their finances effectively.