Catatan Akademik| Senior citizens targets of scammers! Combating financial fraud via design thinking!

Published by

By DR JESRINA ANN XAVIER and DR CHONG WEI YING

Taylor's University

According to a recent study, financial fraud amongst senior citizens is present in both urban and rural areas.

In fact, these types of financial fraud are also highly underreported in Malaysia, as reporting of these cases is known to cause emotional stress amongst the senior citizens.

Senior citizens are often targets of scammers as they are perceived to have huge amounts of retirement funds.

Since August 2022, there have been multiple cases of senior citizens losing a significant portion of their savings, ranging from RM100,000 to RM1.8 million to various methods of scam.

These scammers are good at playing on the sentiments of the senior citizens who are wanting to financially contribute to their families.

There have even been instances where senior citizens are unaware that they are scammed, even after losing huge sums of money.

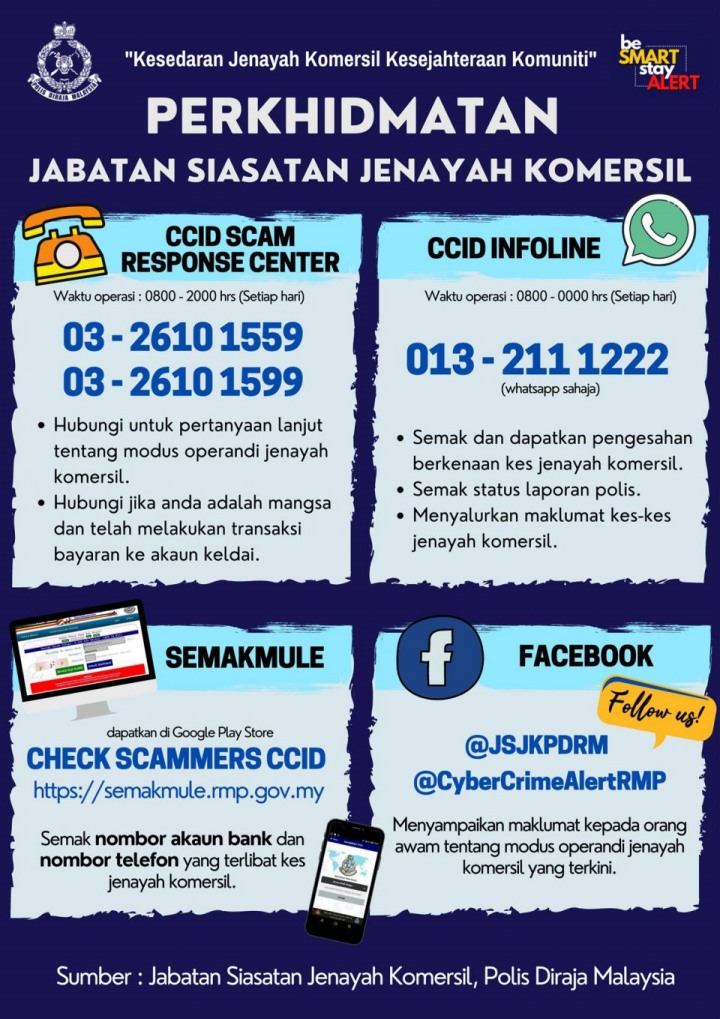

The problem remains widespread and law enforcement is working hard to search for avenues where future cases might be prevented.

It would be prudent to consider alternative approaches in tackling the issue.

Design thinking is a problem-solving approach that involves empathy for the user, collaboration, iteration, and experimentation.

It can be used to combat financial fraud amongst senior citizens by focusing on their specific needs, challenges and behaviors.

Design thinking begins with empathy for its users, in this case, senior citizens who are vulnerable to financial fraud.

Design thinkers will be able to understand their needs, desires, fears, and challenges when it comes to managing their finances.

This can be done through user research, such as interviews, surveys and observations.

Once a deep understanding of the senior citizens’ needs and challenges is gained, the problem can be defined accurately.

Design thinkers may discover that senior citizens may have difficulty identifying fraudulent emails or phone calls, or they may be easily confused by complex financial products.

The next step is to brainstorm and generate potential solutions to the problem. Design thinkers should aim for quantity at this stage and consider a wide range of options.

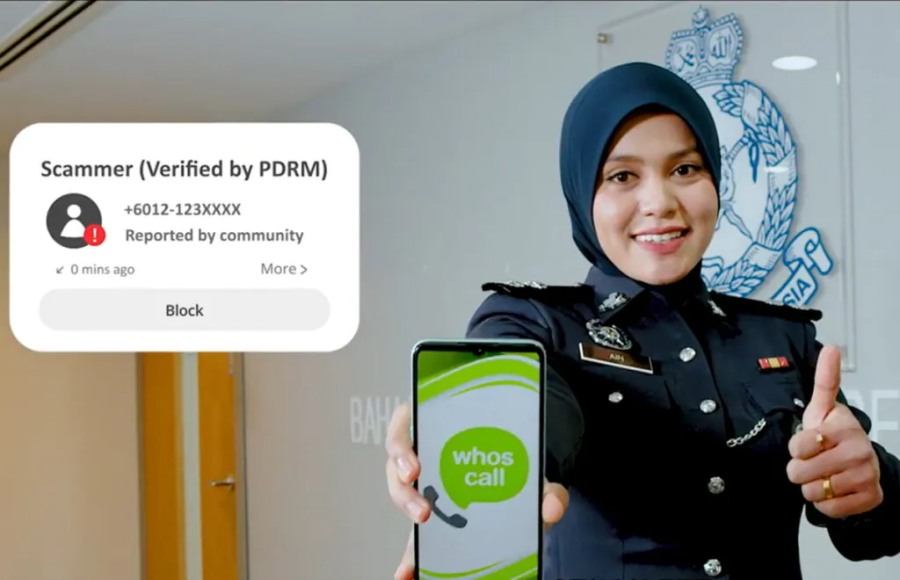

Here, design thinkers may consider developing a simple, easy-to-use application that helps senior citizens identify fraudulent activity, or they may consider creating an educational program that teaches senior citizens how to avoid financial scams.

After generating potential solutions, design thinkers can create prototypes or mockups of their ideas to test them with the senior citizens.

This allows them to get feedback and refine their ideas before investing significant resources into developing a final solution.

Design thinkers may create a prototype of an application and test it with a group of older people to see how easy it is to use and whether it helps them avoid fraudulent activity.

Once design thinkers have developed a solution, they can implement it and continue to iterate and refine the solution based on feedback and data.

An application can be released to a wider audience to collect data on how it is being used and whether it is effective at preventing financial fraud.

It is now time for us to empathize with the senior citizens in combating financial fraud. It is through observation and engagement that a design to solve this critical problem can be found.

As aptly expressed by Bryant McGill, ‘The solution to nearly every problem in the world comes down to greater awareness, compassion and empathy’.

DR JESRINA ANN XAVIER and ASSOCIATE PROFESSOR DR CHONG WEI YING are lecturers from the School of Management and Marketing, Faculty of Business and Law at Taylor’s University. This article is the authors' personal opinion.

DR JESRINA ANN XAVIER

DR CHONG WEI YING